GST Registration

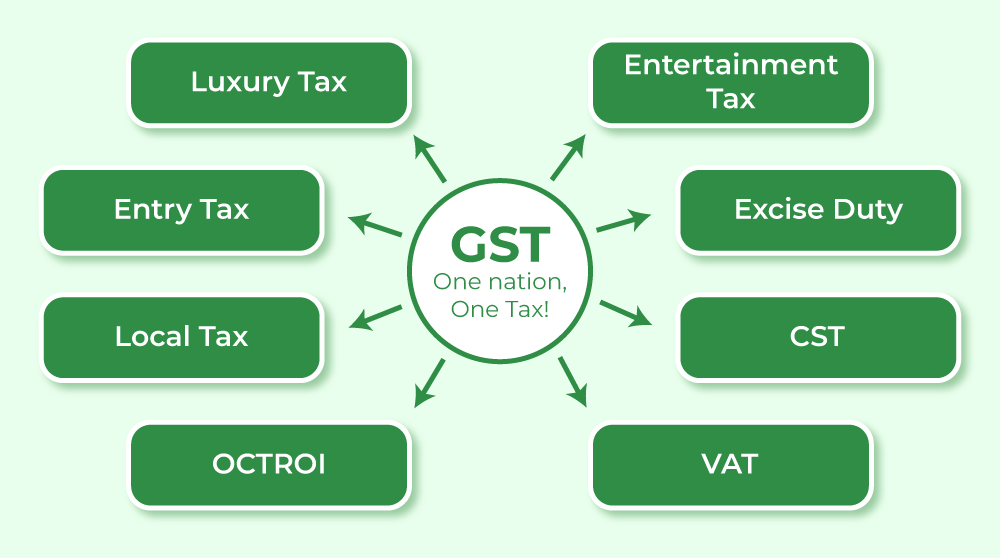

GST (Goods and Services Tax) is a comprehensive indirect tax system that has replaced many central and state taxes in India. GST is levied on the supply of goods and services at each stage of the value chain. GST aims to simplify the tax structure, eliminate cascading of taxes, widen the tax base, and improve compliance.

GST registration is mandatory for businesses whose turnover exceeds the threshold limit of Rs. 40 lakhs (Rs. 10 lakhs for special category states). GST registration is also required for certain categories of businesses irrespective of their turnover, such as e-commerce operators, inter-state suppliers, casual taxable persons, non-resident taxable persons, etc.

GST registration can be done online through the GST portal (www.gst.gov.in) or through a GST facilitation center. The process involves filling an application form https://reg.gst.gov.in/registration/ (GST REG-01), submitting the required documents, verifying the application through an OTP or EVC, and receiving an acknowledgement number (GST REG-02). The GST officer will then examine the application and approve or reject it within 3 working days. If approved, a certificate of registration (GST REG-06) will be issued along with a unique GSTIN (Goods and Services Tax Identification Number). If rejected, a notice of rejection (GST REG-05) will be sent along with the reasons for rejection.

GST Registration step to step guid :-

- For Normal Taxpayer -https://tutorial.gst.gov.in/userguide/registration/index.htm#t=Apply_for_Registration_Normal_Taxpayer.htm

GST registration has many benefits for businesses, such as:

- Eligibility to claim input tax credit (ITC) on purchases

- Ability to collect GST from customers and pass on the tax burden

- Compliance with the law and avoidance of penalties

- Access to online GST portal for filing returns and paying taxes

- Enhanced credibility and competitiveness in the market

For example, a manufacturer who is registered under GST can claim ITC on the raw materials he purchases from his suppliers, who are also registered under GST. He can also charge GST on his final product and collect it from his customers, who can claim ITC on their purchases. This way, GST eliminates double taxation and reduces the cost of production and consumption.

GST registration also comes with certain responsibilities, such as:

- Issuing GST-compliant invoices and receipts

- Maintaining proper books of accounts and records

- Filing periodic GST returns and paying taxes on time

- Reconciling ITC claims with suppliers' returns

- Updating any changes in business details or cancelling registration if required

For example, a retailer who is registered under GST has to issue invoices with his GSTIN and other details to his customers. He has to maintain records of his sales and purchases and file monthly or quarterly returns on the GST portal. He has to pay taxes based on his turnover and input tax credit. He has to match his ITC claims with his suppliers' returns and rectify any discrepancies. He has to inform the authorities if he changes his address, bank account, business name, etc.

GST registration is a crucial step for any business that wants to operate in the GST regime. It is advisable to consult a tax expert or a GST practitioner for guidance on GST registration and compliance.

.jpg)

No comments:

Post a Comment